Viimeisen vuosineljänneksen liikevaihto oli ennätykselliset 14,9 miljardia dollaria

Helsinki, 15.1.2016 – Intel on julkistanut tietoja vuoden 2015 tuloksestaan. Yhtiön koko vuoden liikevaihto vuonna 2015 oli 55,4 miljardia Yhdysvaltain dollaria, liikevoitto 14,0 miljardia dollaria, tulos 11,4 miljardia dollaria ja osakekohtainen tulos 2,33 dollaria. Liiketoiminnan kassavirta oli 19,0 miljardia dollaria. Yhtiö maksoi osakkeenomistajille osinkoina yhteensä 4,6 miljardia dollaria ja lunasti omia osakkeitaan yhteensä 3,0 miljardin dollarin arvosta eli 96 miljoonaa kappaletta.

Intelin viimeisen vuosineljänneksen liikevaihto oli 14,9 miljardia dollaria, liikevoitto 4,3 miljardia dollaria, tulos 3,6 miljardia dollaria, osakekohtainen tulos 74 senttiä ja liiketoiminnan kassavirta 5,4 miljardia dollaria. Yhtiö maksoi osakkeenomistajille osinkoina yhteensä 1,1 miljardia dollaria ja lunasti omia osakkeitaan yhteensä 525 miljoonan dollarin arvosta eli 17 miljoonaa kappaletta.

”Viimeisen vuosineljänneksen tulos oli vahva lopetus vuodelle ja vastasi odotuksiamme”, sanoo Intelin toimitusjohtaja Brian Krzanich. ”Vuoden 2015 tuloksemme osoittaa, että Intel kehittyy yhtiönä ja että strategiamme toimii. Tänä vuonna jatkamme kasvuamme rakentamalla infrastruktuuria yhä älykkäämmälle ja kytketymmälle maailmalle.”

Lisätietoja antavat:

Camilla Törnblom

Intel Nordics

Puh. +46 8 5946 1729 tai +46 768 881 729

camilla.tornblom@intel.com

Michael Jääskeläinen

Hill+Knowlton Strategies

Puh. 050 571 0514

michael.jaaskelainen@hkstrategies.com

Intel tekee tulevaisuuden upeimmista kokemuksista mahdollista. Intelin innovaatiot laajentavat henkilökohtaisten laitteiden, palvelinten ja pilven laskentatehoa ja ulottuvuuksia, tekevät asioiden internetistä älykkään ja kytketyn, ja pitävät yllä digitaalisen elämän turvallisuutta. Yli 100 000 ihmistä työllistävä yhtiö mullistaa yritysten liiketoimintaa, edistää uusia keksintöjä ja parantaa ihmisten elämää.

Lisätietoja Intelistä saa kansainvälisiltä sivustoilta osoitteista newsroom.intel.com/ ja intel.com/. Suomessa Intelin uutisia julkaistaan myös Twitterissä osoitteessa https://twitter.com/IntelFinland.

Tiedote kokonaisuudessaan alla:

Intel Reports Full-Year Revenue of $55.4 Billion, Net Income of $11.4 Billion

Reports Record Quarterly Revenue of $14.9 Billion

News Highlights:

- Record full-year revenue in the Data Center, Internet of Things (IoT) and Non-Volatile Memory Solutions Groups; and record quarterly revenue in the Data Center and IoT Groups

- As of November, 14nm products made up more than 50 percent of Client Computing Group volume with growing enthusiasm for 6th Generation Intel® Core™ ("Skylake") processors

- Announced increase in cash dividend to $1.04-per-share on an annual basis

- Altera acquisition closed early in the first quarter of 2016, broadening Intel's portfolio

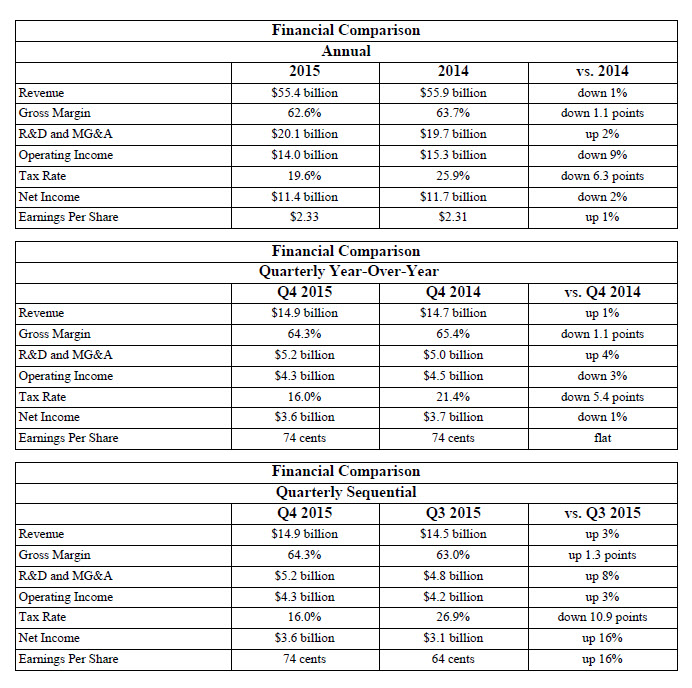

SANTA CLARA, Calif., January 14, 2016 -- Intel Corporation today reported full-year revenue of $55.4 billion, operating income of $14.0 billion, net income of $11.4 billion and EPS of $2.33. The company generated approximately $19.0 billion in cash from operations, paid dividends of $4.6 billion and used $3.0 billion to repurchase 96 million shares of stock.

For the fourth quarter, Intel posted revenue of $14.9 billion, operating income of $4.3 billion, net income of $3.6 billion and EPS of 74 cents. The company generated approximately $5.4 billion in cash from operations, paid dividends of $1.1 billion, and used $525 million to repurchase 17 million shares of stock.

"Our results for the fourth quarter marked a strong finish to the year and were consistent with expectations," said Brian Krzanich, Intel CEO. "Our 2015 results demonstrate that Intel is evolving and our strategy is working. This year, we'll continue to drive growth by powering the infrastructure for an increasingly smart and connected world."

Full-Year 2015 Business Unit Trends

- Client Computing Group revenue of $32.2 billion, down 8 percent from 2014.

- Data Center Group revenue of $16.0 billion, up 11 percent from 2014.

- Internet of Things Group revenue of $2.3 billion, up 7 percent from 2014.

- Software and services operating segments revenue of $2.2 billion, down 2 percent from 2014.

- Non-Volatile Memory Solution Group revenue up 21 percent from 2014.

Q4 Business Unit Trends

- Client Computing Group revenue of $8.8 billion, up 3 percent sequentially and down 1 percent year-over-year.

- Data Center Group revenue of $4.3 billion, up 4 percent sequentially and up 5 percent year-over-year.

- Internet of Things Group revenue of $625 million, up 8 percent sequentially and up 6 percent year-over-year.

- Software and services operating segments revenue of $543 million, down 2 percent sequentially and down 3 percent year-over-year.

- Non-Volatile Memory Solution Group revenue was flat sequentially and up 10 percent year-over-year.

Business Outlook

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments and other significant transactions that may be completed after January 14.

Please note: Our Full-Year 2016 and Q1 2016 Business Outlook includes the expected results of our recently completed acquisition of Altera, an additional week in the first quarter due to 2016 being a 53-week year and a change in the estimated useful lives for our machinery and equipment in our factories from four to five years.

The acquisition of Altera was completed in early fiscal year 2016, which means that the 2016 guidance includes the expected results for the FPGA business. As a result of the Altera acquisition, we have acquisition-related charges that are primarily non-cash. Our guidance for the first quarter and full-year 2016 include both GAAP and non-GAAP estimates. Reconciliations between these GAAP and non-GAAP financial measures are included below.

For additional information regarding Intel's results and Business Outlook, please see the CFO commentary at:www.intc.com/results.cfm.

Status of Business Outlook

Intel's Business Outlook is posted on intc.com and may be reiterated in public or private meetings with investors and others. The Business Outlook will be effective through the close of business on March 18 unless earlier updated; except that the Business Outlook for amortization of acquisition-related intangibles, impact of equity investments and interest and other, restructuring charges, and tax rate, will be effective only through the close of business on January 21. Intel's Quiet Period will start from the close of business on March 18 until publication of the company's first-quarter earnings release, scheduled for April 19. During the Quiet Period, all of the Business Outlook and other forward-looking statements disclosed in the company's news releases and filings with the SEC should be considered as historical, speaking as of prior to the Quiet Period only and not subject to an update by the company.

Risk Factors

The above statements and any others in this release that refer to future plans and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as "anticipates," "expects," "intends," "goals," "plans," "believes," "seeks," "estimates," "continues," "may," "will," "should," and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on projections, uncertain events or assumptions also identify forward-looking statements. Many factors could affect Intel's actual results, and variances from Intel's current expectations regarding such factors could cause actual results to differ materially from those expressed in these forward-looking statements. Intel presently considers the following to be important factors that could cause actual results to differ materially from the company's expectations.

- Demand for Intel's products is highly variable and could differ from expectations due to factors including changes in business and economic conditions; consumer confidence or income levels; the introduction, availability and market acceptance of Intel's products, products used together with Intel products and competitors' products; competitive and pricing pressures, including actions taken by competitors; supply constraints and other disruptions affecting customers; changes in customer order patterns including order cancellations; and changes in the level of inventory at customers.

- Intel's gross margin percentage could vary significantly from expectations based on capacity utilization; variations in inventory valuation, including variations related to the timing of qualifying products for sale; changes in revenue levels; segment product mix; the timing and execution of the manufacturing ramp and associated costs; excess or obsolete inventory; changes in unit costs; defects or disruptions in the supply of materials or resources; and product manufacturing quality/yields. Variations in gross margin may also be caused by the timing of Intel product introductions and related expenses, including marketing expenses, and Intel's ability to respond quickly to technological developments and to introduce new products or incorporate new features into existing products, which may result in restructuring and asset impairment charges.

- Intel's results could be affected by adverse economic, social, political and physical/infrastructure conditions in countries where Intel, its customers or its suppliers operate, including military conflict and other security risks, natural disasters, infrastructure disruptions, health concerns and fluctuations in currency exchange rates. Results may also be affected by the formal or informal imposition by countries of new or revised export and/or import and doing-business regulations, which could be changed without prior notice.

- Intel operates in highly competitive industries and its operations have high costs that are either fixed or difficult to reduce in the short term.

- The amount, timing and execution of Intel's stock repurchase program could be affected by changes in Intel's priorities for the use of cash, such as operational spending, capital spending, acquisitions, and as a result of changes to Intel's cash flows or changes in tax laws.

- Intel's expected tax rate is based on current tax law and current expected income and may be affected by the jurisdictions in which profits are determined to be earned and taxed; changes in the estimates of credits, benefits and deductions; the resolution of issues arising from tax audits with various tax authorities, including payment of interest and penalties; and the ability to realize deferred tax assets.

- Gains or losses from equity securities and interest and other could vary from expectations depending on gains or losses on the sale, exchange, change in the fair value or impairments of debt and equity investments, interest rates, cash balances, and changes in fair value of derivative instruments.

- Product defects or errata (deviations from published specifications) may adversely impact our expenses, revenues and reputation.

- Intel's results could be affected by litigation or regulatory matters involving intellectual property, stockholder, consumer, antitrust, disclosure and other issues. An unfavorable ruling could include monetary damages or an injunction prohibiting Intel from manufacturing or selling one or more products, precluding particular business practices, impacting Intel's ability to design its products, or requiring other remedies such as compulsory licensing of intellectual property.

- Intel's results may be affected by the timing of closing of acquisitions, divestitures and other significant transactions. We completed our acquisition of Altera on December 28, 2015 and risks associated with that acquisition are described in the "Forward Looking Statements" paragraph of Intel's press release dated June 1, 2015, which risk factors are incorporated by reference herein.

A detailed discussion of these and other factors that could affect Intel's results is included in Intel's SEC filings, including the company's most recent reports on Forms 10-K and 10-Q.

Earnings Webcast

Intel will hold a public webcast at 2 p.m. PDT today on its Investor Relations website at www.intc.com. A webcast replay and audio download will also be available on the site.

Intel plans to report its earnings for the first quarter of 2016 on April 19. Immediately following the earnings report, the company plans to publish a commentary by Stacy J. Smith, Intel CFO and executive vice president, at www.intc.com/results.cfm. A public webcast of Intel's earnings conference call will follow at 2 p.m. PDT at www.intc.com.

About Intel

Intel (NASDAQ: INTC) is a world leader in computing innovation. The company designs and builds the essential technologies that serve as the foundation for the world's computing devices. As a leader in corporate responsibility and sustainability, Intel also manufactures the world's first commercially available "conflict-free" microprocessors. Additional information about Intel is available at newsroom.intel.com and blogs.intel.com and about Intel's conflict-free efforts at conflictfree.intel.com.

Intel, the Intel logo, Core, and Ultrabook are trademarks of Intel Corporation in the United States and other countries.

*Other names and brands may be claimed as the property of others.

CONTACTS:

Trey Campbell

Investor Relations

503-696-0431

trey.s.campbell@intel.com

Cara Walker

Media Relations

503-696-0831

cara.walker@intel.com